Ray Dalio Sounds The Alarm Today As US Teeters On The Edge Of Something Worse Than A Recession – Financial Freedom Countdown

In a sobering interview, Ray Dalio, founder of Bridgewater Associates and author of the upcoming book “How Countries Go Broke”, laid out a chilling roadmap of what he believes lies ahead for the United States and the global economy.

Drawing parallels to the 1930s, Dalio argues that the country is at a dangerous crossroads where financial imbalances, internal division, and geopolitical tensions could culminate in a historic upheaval.

The Five Forces Driving Historical Changes

Dalio identified five recurring forces throughout history that drive major societal and economic shifts: monetary policy and debt cycles, internal political conflict, changes in the global order, technological disruptions, and acts of nature.

These forces, he contends, are converging now in a particularly volatile mix. “We’re seeing profound changes in our monetary, political, and world order,” he said, warning that the current moment echoes the lead-up to past global crises.

The Hidden Crisis Behind Tariffs and Trade Conflicts

While much attention has been focused on President Trump’s tariffs, Dalio sees them as a symptom rather than the root cause.

He emphasized that the real issue lies in how the U.S. manages its trade imbalances and domestic manufacturing strategy. Poorly handled, tariffs could act like “throwing rocks into the production system,” causing global inefficiencies and heightened tensions rather than resolving long-term problems.

Are Tariffs Making Things Worse?

Dalio was blunt: the current implementation of tariffs is “very disruptive.”

He stressed that while the goals of raising revenue and strengthening domestic jobs are valid, the means matter greatly.

Without careful negotiation and stability, such policies may end up doing more harm than good. The long-term ripple effects of supply chain disruptions, he argued, will be costly across the global economy.

When asked directly about the possibility of a recession, Dalio didn’t mince words. “Right now we are at a decision-making point and very close to a recession. And I’m worried about something worse than a recession if this isn’t handled well.”

If the current trajectory continues, he fears a broader breakdown of the monetary system and global cooperation that could mirror the Great Depression in scale and impact.

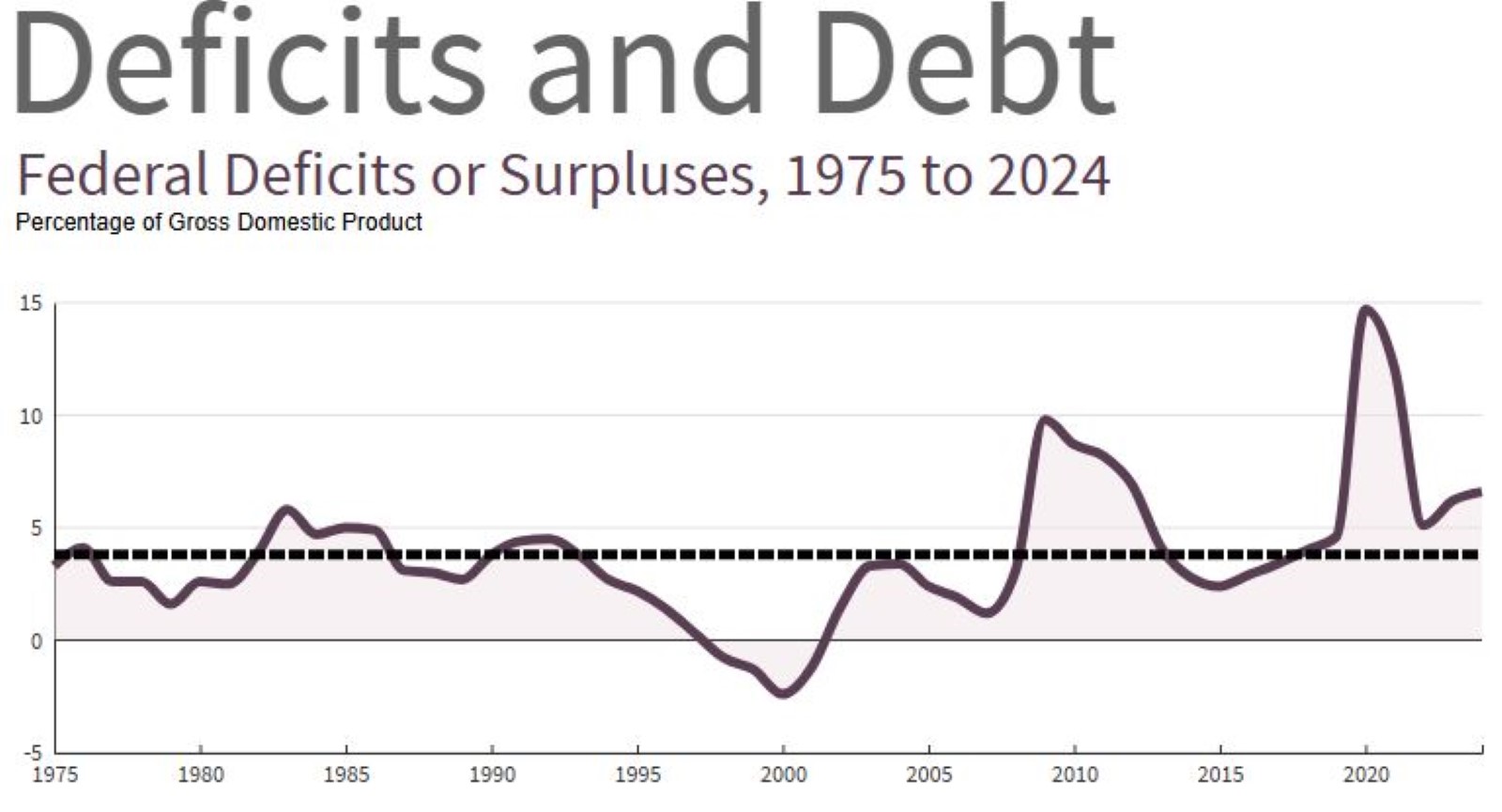

Why the U.S. Budget Deficit Matters More Than Ever

Dalio proposed a clear benchmark to prevent further deterioration: reducing the U.S. budget deficit to 3% of GDP.

Currently projected to hit around 7%, the deficit represents a huge problem. Without significant changes, the U.S. faces a supply-demand mismatch for debt, which could destabilize financial markets and undermine investor confidence.

Federal Deficit in 2024 Was $1.8 Trillion

As per the Congressional Budget Office, the federal deficit in 2024 was $1.8 trillion, equal to 6.4 percent of gross domestic product.

Deficit is defined as the amount by which outlays exceed revenues. To fund government spending in years of deficits, the Treasury borrows from individuals, businesses, the Federal Reserve, and other countries.

The average deficit over the past 50 years has hovered around 3.8% of GDP. It spiked to 14.7% during 2020 and dropped to 5.1% by 2022. However since then the deficit has been steadily creeping higher.

The Declining Value of Money

One of Dalio’s gravest concerns is the erosion of the dollar’s value as a store of wealth.

When government debt becomes too large and monetary inflation sets in, traditional safe-haven assets like bonds are threatened. This could trigger a broader crisis of faith in the financial system, similar to the collapse of the Bretton Woods system in 1971 or the 2008 meltdown—but potentially worse.

The Fragile State of America

Another undercurrent in Dalio’s warning is the internal conflict brewing within the U.S.—between the political left and right, the rich and poor, and competing values.

This polarization threatens the stability of democratic institutions. “It is not the normal democracy as we know it,” he said, implying that continued division could result in social unrest or governance breakdowns.

Global Conflict Is No Longer Unthinkable

Dalio didn’t shy away from the potential for international conflict either. As rising powers challenge the U.S.-led global order, the risk of geopolitical strife—including military conflict—grows. “We are going from multilateralism, which is largely an American world order type of thing, to a unilateral world order in which there’s great conflict,” he said, echoing tensions reminiscent of the pre-WWII environment.

In a post on X, Dalio called for the U.S. to negotiate a “win-win” trade agreement with China that would appreciate the yuan against the dollar. He also called for both countries to address their growing debts.

He expressed optimism over “President Trump’s decision to step back from a worse way and negotiate how to deal with these imbalances is a much better way.”

He called on the Chinese government to “restructure and monetize their excessive local government debts to get their debt overhang behind them.”

A Systemic Breakdown Is Not Inevitable—But Close

Despite the gravity of his warnings, Dalio emphasized that catastrophe is not unavoidable.

Key among his recommendations is what he calls the “3% pledge” for fiscal responsibility. With deliberate, bipartisan efforts to restructure debt, manage trade sensibly, and restore public trust, the country can steer clear of the worst outcomes including recession.

But time is running short.

He said, “The next Trump administration move should be to deal with the deficit well by cutting the deficit to 3pct of GDP.”

What Can Be Done: Dalio’s Prescription

In his upcoming book, How Countries Go Broke, Dalio lays out a playbook for how nations can avert collapse by recognizing cycles and acting early.

At the core is a blend of monetary reform, bipartisan cooperation, and strategic planning. The U.S., he believes, still has the tools to correct course—but only if it acts decisively, and soon.

Dalio correctly predicted the 2008 Great Financial Crisis and is credited with the creation of the All Weather portfolio.

The entire interview with NBC News “Meet the Press” contains some thought provoking ideas based on the current economic environment.

Like Financial Freedom Countdown content? Be sure to follow us!

What SECURE Act 2.0 Means for Your Future Retirement Plan

Three years on from the groundbreaking SECURE Act, which revolutionized America’s retirement landscape for the first time in a decade, the SECURE Act 2.0 sequel legislation aims to widen the gateway to retirement plans and benefits, introducing pivotal changes like automatic enrollment in select workplace pensions, increased catch-up contributions for the seasoned workforce, and extended retirement saving opportunities for part-time employees. Moreover, it promises to bolster individuals’ ability to set aside emergency funds, ensuring swift access in times of need, marking another significant stride toward securing a more financially stable future for all. Here are some of the key provisions.

What SECURE Act 2.0 Means for Your Future Retirement Plan

Exploring Government Programs Granting Free Land for Affordable Homeownership: From Colorado to Iowa

Small towns across the US are offering free land for those ready to build homes and contribute to their communities. As housing costs soar nationwide, these towns are innovating to attract new residents and revitalize their local economies. From the Midwest to the Mountain states, these programs offer more than just affordable homeownership; they invite you to join a tight-knit community and embrace a whole new way of life.

Exploring Government Programs Granting Free Land for Affordable Homeownership: From Colorado to Iowa

The Social Security Administration (SSA) has reinstated a controversial policy that could significantly impact seniors’ finances.

Starting March 27, 2025, the SSA will begin withholding 100% of overpayments from Social Security recipients’ benefits, reversing the previous policy that allowed for just 10% withholding. This change is expected to recover approximately $7 billion over the next decade but has raised serious concerns about the financial well-being of vulnerable Americans.

More than 1.1 million Americans have received long-awaited retroactive Social Security payments, with an average payout of $6,710. While this unexpected windfall is welcome news for many, it could come with an unexpected downside—higher taxable income. The Social Security Administration (SSA) confirmed in a March 4 announcement that $7.5 billion has already been distributed following the passage of the Social Security Fairness Act.

Updated monthly benefits for eligible recipients will begin in April, but financial experts warn that these lump-sum payments could push some retirees into a higher tax bracket, potentially increasing their tax burden for the year.

Social Security Sends Over $7.5 Billion in Retroactive Benefits —But Some May Face a Tax Surprise

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.